8 Best HMOs in the Philippines for Self-Employed and Freelancers

We all know that being a Filipino freelancer comes with its pros and cons.

Good pay and flexible time are the most assured benefits. But what about the disadvantages, such as health insurance or HMOs?

If you’re here to find out which HMO is right for you, then this article is definitely for you.

below, you’ll discover the best HMOs available to Filipino freelancers, along with tips and additional information.

Why Get an HMO If You’re Self-Employed in the Philippines?

An HMO offers comprehensive healthcare coverage, financial stability, and easy access to quality care.

It covers both inpatient and outpatient services, emergency care, and specialized treatments. Fixed monthly premiums and cashless transactions help manage costs without surprises. With a wide network of accredited providers nationwide, you get convenient access to quality healthcare, making an HMO a smart choice for freelancers.

If you value your health like anyone else, then getting an HMO should definitely be a top priority.

What are the Best HMOs For Filipino Freelancers Right Now?

Maxicare, MediCard (Standard), Pacific Cross Select/Blue Royal, and AXA GHA are some of the best HMOs that you can avail yourself of right now if you’re a Filipino freelancer.

To add more depth to this, read through the details below.

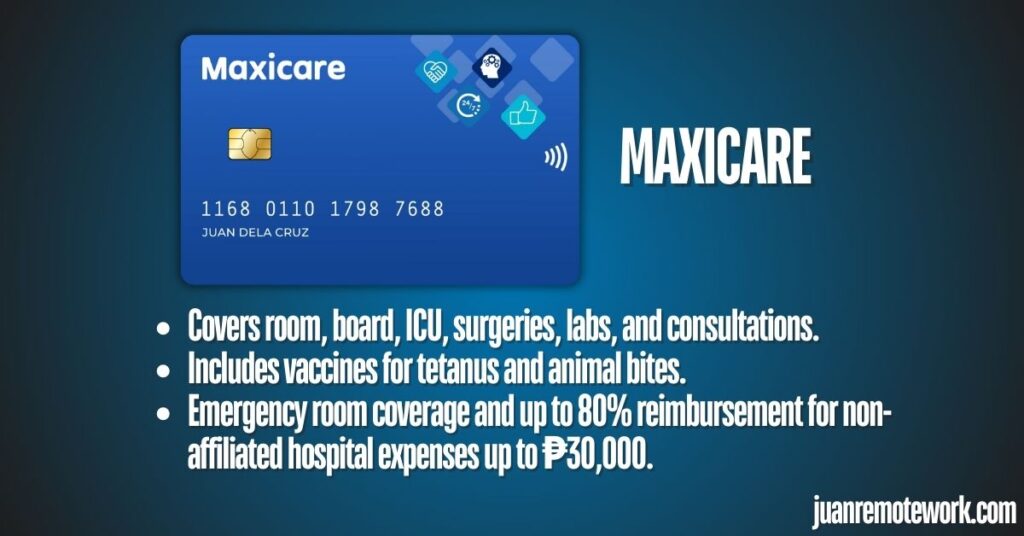

1. Maxicare

Maxicare is one of the leading HMOs in the Philippines, providing comprehensive healthcare coverage through its wide network of hospitals and clinics.

It offers various plans tailored to meet the diverse needs of individuals, including freelancers. Maxicare’s plans are designed to ensure that members have access to a wide range of medical services, making healthcare more accessible and affordable.

Features & Benefits

- Inpatient Care:

- Room and board accommodation

- Use of Operating Room, Intensive Care Unit (ICU), Isolation Room, and Recovery Room

- Professional fees for attending physicians, surgeons, anesthesiologists, and cardiopulmonary specialists

- Outpatient Care:

- X-ray, laboratory examinations, routine, diagnostic and therapeutic procedures

- Consultations and treatment of minor injuries

- Minor surgery not requiring confinement

- Preventive Care:

- Passive and active vaccines for treatment of tetanus and animal bites

- Emergency Care:

- Coverage for life-threatening or unexpected conditions requiring immediate alleviation within 24 hours, including confinement in a regular private room.

- Non-Affiliated Hospitals (Within the Philippines): Reimbursement up to 80% of hospital bills and professional fees (based on Maxicare rates) incurred within the first 24 hours up to ₱30,000 per availment/member.

Choose Maxicare If:

- Comprehensive Coverage: You need extensive coverage that includes inpatient, outpatient, emergency care, and preventive services.

- Large Network: You prefer having access to a wide network of hospitals and clinics nationwide.

- Specialized Services: You require specific healthcare services such as dental care, speech therapy, and allergy testing.

- Budget: You are looking for a plan with various cost options starting at PHP 699 per month, making it accessible for different budgets.

Cost

Maxicare plans are structured to cater to various budgetary needs.

Basic plans start at ₱699 per month, providing access to comprehensive healthcare services and additional wellness programs.

More detailed information and customizable plan options can be explored through their official site.

2. Medicard (Standard)

Medicard offers a comprehensive health maintenance organization (HMO) plan known as the Medicard Standard Individual and Family Plan.

This plan is ideal for freelancers, individuals, and families seeking quality healthcare services from a vast network of over 59,000 accredited doctors and more than 2,000 hospitals and clinics nationwide.

The plan provides extensive coverage for various medical needs, including inpatient care, outpatient care, emergency services, annual physical exams, and dental care.

Notably, it includes access to top-tier hospitals and covers pre-existing conditions from the second year of continuous membership onwards.

Features & Benefits

- Hospital Confinement:

- No deposit required upon admission

- Room and board according to enrollment type

- Use of operating theater and recovery room

- Out-Patient Care:

- Referral to specialists

- Regular consultations and treatment (excluding prescribed medicines)

- Eye, ear, nose, and throat treatment

- Preventive Health Care:

- Annual physical examination (including CBC, urinalysis, fecalysis, chest X-ray, ECG for adults 40+, Pap smear for women 40+)

- Routine immunization (excluding cost of vaccines)

- Counseling on health habits, diets, and family planning

- Emergency Care:

- Services in accredited hospitals/clinics: doctor’s services, medicines, oxygen, IV fluids, dressings, plaster casts, sutures, laboratory, X-ray, and other diagnostic exams

- Reimbursement for services in non-accredited hospitals (80% up to ₱30,000)

- Dental Care:

- Annual oral prophylaxis

- Consultations and oral examinations

- Simple tooth extractions (except surgery for impacted tooth)

Choose Medicard (Standard) If:

- In-Depth Hospital Coverage: You prioritize comprehensive inpatient care, including ICU, surgery, and special therapeutic modalities.

- Preventive Healthcare: You want robust preventive care options including annual physical exams and routine immunizations.

- Emergency and Outpatient Services: You need reliable emergency services and coverage for minor outpatient procedures and diagnostics.

- Flexibility: You prefer a plan that allows coverage for a wide range of medical services and offers assistance with administrative requirements.

Cost

The cost of the Medicard Standard Individual and Family Plan varies based on the specific coverage options chosen. Detailed pricing and customizable plan options can be explored on the official Medicard website.

3. Pacific Cross Select

Pacific Cross Select provides two main plans—Select Plus and Select Standard—offering comprehensive medical coverage with flexibility in choosing medical providers. These plans cater to individuals and families seeking high-quality healthcare services with significant coverage limits.

Features & Benefits

- Maximum Coverage:

- Select Plus: Up to PHP 5,000,000 per year

- Select Standard: Up to PHP 2,000,000 per disability per lifetime

- In-Patient Benefits:

- Room and Board (including general nursing care)

- Miscellaneous In-Patient Charges: Coverage for diagnostic tests, prescribed medicines, anesthesia, surgical appliances, and more as charged.

- Professional Fees: As charged.

- Out-Patient Benefits:

- Coverage for selected procedures such as cataract extraction, biopsies, and more, subject to the limits of the surgical benefits.

- Coverage for chemotherapy, radiotherapy, dialysis, and more, up to the maximum coverage limit.

- Emergency Care:

- Provides medical assistance and coverage for emergencies occurring outside the Philippines.

- Additional Benefits:

- Personal Accident Benefit: PHP 75,000

- Travel+ Benefits: PHP 50,000

Choose Pacific Cross Select If:

- High Coverage Limits: You need a plan with high annual coverage limits, up to PHP 5,000,000.

- Customizability: You want the flexibility to choose your own hospitals and doctors, with comprehensive reimbursement options.

- Travel Coverage: You require international health insurance and emergency overseas coverage.

- Additional Benefits: You appreciate added features such as personal accident benefits and travel-related assistance.

Cost

The cost of the Pacific Cross Select plans varies based on the specific coverage options and additional benefits chosen. For detailed pricing and customization options, please visit the official Pacific Cross website.

4. Pacific Cross Blue Royale

Pacific Cross Blue Royale is one of the most comprehensive medical insurance plans available in the Philippines, providing extensive coverage and the freedom to choose the best medical treatment worldwide.

With an impressive annual coverage limit of USD 2,000,000, Blue Royale ensures that you receive top-quality healthcare services wherever you are.

Features & Benefits

- In-Patient Benefits:

- Daily Limit for Philippine confinement: Up to USD 850.

- Daily Limit for Overseas confinement: Private room up to USD 1,500.

- Coverage for diagnostic tests, prescribed medicines, anesthesia, surgical appliances, and more, as charged.

- Out-Patient Benefits:

- Coverage for consultations and treatments with specialists.

- Coverage for necessary diagnostic tests.

- Coverage for minor surgical procedures not requiring confinement.

- Emergency Care:

- Medical assistance and coverage for emergencies occurring outside the Philippines.

- Services included.

- Coverage for repatriation of mortal remains.

- Maternity and Childbirth:

- Coverage for childbirth and related medical expenses.

- Post-Hospitalization Treatment:

- Coverage for follow-up consultations and treatments after hospitalization.

Choose Pacific Cross Blue Royale If:

- Global Coverage: You need the freedom to choose medical providers anywhere in the world.

- Extensive Benefits: You want a high annual benefit limit of up to USD 2,000,000, covering both medical and travel insurance needs.

- Specialized Care: You require coverage for maternity and childbirth, as well as emergency medical evacuation and repatriation.

- Premium Services: You value optional dental and vision benefits, and the convenience of global concierge services.

Cost

The cost of the Pacific Cross Blue Royale plan varies based on the specific coverage options and additional benefits chosen. Detailed pricing and customization options can be explored on the Pacific Cross Blue Royale page.

5. AXA Global Health Access

AXA Global Health Access is a premier health insurance plan offering extensive medical coverage worldwide.

Designed for those who seek comprehensive health protection, it provides coverage for both inpatient and outpatient treatments, with significant flexibility in choosing healthcare providers and accessing specialized services.

Features & Benefits

- Inpatient Care:

- Coverage for hospitalization expenses.

- Option for U.S. coverage.

- Outpatient Care:

- Pre and post-hospitalization coverage for 90 days.

- 15 consultation visits up to PHP 1,000 per visit.

- Emergency Care:

- Coverage for emergency outpatient treatment due to accidents.

- Dental Care:

- Coverage for dental procedures (varies by plan).

- Alternative Treatment:

- Coverage for alternative treatments (varies by plan).

- Optical Care:

- Coverage for optical care services (varies by plan).

- Maternity Care:

- Coverage for maternity-related medical expenses (varies by plan).

Choose AXA Global Health Access If:

- Wide-Ranging Coverage: You need extensive medical coverage worldwide with high benefit limits up to PHP 175 million.

- Freedom of Choice: You prefer the ability to consult with any specialist, even outside AXA’s network.

- Cashless Transactions: You want the convenience of direct payment to network providers for inpatient expenses.

- Mental Health Services: You value access to mental health counseling and 24/7 teleconsultation services.

Cost

For detailed pricing and plan customization options, please visit their AXA Global Health Access page.

6. AXA Health Care Access

AXA Health Care Access is an award-winning family healthcare plan designed to provide comprehensive protection, covering a wide range of medical needs from hospitalization to preventive care. This plan offers flexibility in coverage options and ensures access to a vast network of accredited healthcare providers nationwide.

Features & Benefits

- Complete Health Care Coverage:

- Hospitalization: Coverage for inpatient care including surgery and related services.

- Outpatient Care: Coverage for consultations, diagnostics, and minor procedures.

- Emergency Care: Coverage for medical emergencies including accidents and urgent care needs.

- Preventive Care: Includes services such as annual physical exams, vaccinations, and screening tests.

- Wide Range of Plan Types:

- Choose from five annual benefit options with coverage ranging from PHP 500,000 to PHP 5 million. These plans can supplement existing HMO coverage.

- Access to Accredited Providers Nationwide:

- Over 1,400 AVEGA accredited clinics in the network, ensuring broad access to medical services.

- Longevity Health Fund:

- A lump sum guaranteed to be received at age 76 onwards, covering future medical needs post-retirement.

- Women-Specific Illness Coverage:

- Includes hysteroscopic procedures, sonomammogram tests, and pelvic ultrasounds for diagnosing and treating women-specific health issues.

Choose AXA Health Care Access If:

- Complete Health Care: You require comprehensive coverage including hospitalization, surgery, outpatient, emergency, and preventive care.

- Flexibility: You need various annual benefit options, ranging from PHP 500,000 to PHP 5 million, to supplement your existing HMO coverage.

- Longevity Benefits: You want coverage for future medical needs with a longevity health fund.

- Family Plan: You are looking for a family plan with premium reduction for enrolling multiple members.

Cost

For detailed pricing and customization options, visit their AXA Health Care Access page.

7. Philcare ER Vantage Plus 80 for Adults

ER Vantage Plus 80 for Adults is a single-use healthcare plan provided by PhilCare, offering substantial coverage for emergency care and hospitalization due to viral and bacterial illnesses or injuries resulting from accidents.

It ensures access to a network of over 500 accredited hospitals across the Philippines, making it a valuable option for adults seeking reliable emergency healthcare.

Features & Benefits

- Coverage Limit:

- Up to PHP 80,000 for emergency care and hospitalization.

- Eligibility and Validity:

- Available for adults aged 18 to 65 years old.

- Valid for 1 year upon activation, with benefits starting 7 days after activation.

- Certificate of Coverage is non-transferable once activated.

- Emergency Case Definition:

- Sudden, unexpected onset of illness or injury with potential to cause immediate disability or death, or requiring immediate alleviation of severe pain and discomfort.

- Examples include massive bleeding, acute appendicitis, fractures, convulsions, severe dehydration, and syncope.

- Additional Benefits:

- PHP 50,000 accidental death and disability coverage (provided by a third-party insurance provider).

- Exclusions:

- Coverage does not include pre-existing conditions or conditions specified under PhilCare’s general exclusions.

- Refund Policy:

- Clients can examine and cancel the health plan within 15 days from receipt of the Certificate of Coverage if the product hasn’t been utilized. Refunds are subject to PhilCare’s Termination Policy.

Choose ER Vantage Plus 80 for Adults If:

- Emergency Coverage: You need a single-use plan that provides significant emergency care and hospitalization coverage for accidents and illnesses.

- Age Eligibility: You fall within the age range of 18 to 65 years old.

- Cost-Effective: You are looking for a budget-friendly option with a monthly cost of PHP 1,750.

- Accidental Coverage: You want additional benefits like accidental death and disability coverage.

Cost

The cost for ER Vantage Plus 80 for Adults is PHP 1,750.00 per month. For more details, check out Philcare’s page.

8. PhilHealth

PhilHealth, the Philippine Health Insurance Corporation, is the government-run health insurance program designed to ensure that all Filipinos have access to comprehensive healthcare services.

It offers a wide range of benefits covering various medical conditions, procedures, and preventive care.

Features & Benefits

- Inpatient Care:

- Coverage for hospital room and board, drugs, medicines, diagnostic, laboratory tests, operating room fees, and professional fees for confinement in accredited hospitals.

- Outpatient Care:

- Consultations, diagnostic procedures, and treatment including minor surgeries.

- Coverage for preventive services like immunizations, check-ups, and health screenings through the PhilHealth Konsulta Package.

- Emergency Care:

- Coverage for emergency services, including those for sudden, unexpected onset of illness or injury that poses an immediate risk to health.

- Other Benefits:

- Annual Medical Checkups: Free annual check-ups for all members to promote preventive healthcare.

- Health Packages for Children: Special packages for children with developmental disabilities, mobility impairments, visual and hearing impairments.

Choose PhilHealth If:

- Government-Mandated Coverage: You are looking for a basic health insurance plan that is mandatory for all Filipino citizens.

- Comprehensive Benefits: You need coverage for a wide range of medical services including inpatient, outpatient, emergency care, and specialized treatments.

- Affordability: You want a cost-effective health insurance option based on a percentage of your monthly salary.

- Preventive Care: You value access to preventive healthcare services like annual check-ups and health screenings.

By considering these factors, you can choose the HMO that best aligns with your healthcare needs and financial situation.

Cost

PhilHealth contributions are calculated based on a percentage of the member’s salary. As of 2024, the contribution rate is 4.5% of the member’s monthly basic salary, shared equally between the employer and the employee.

For self-employed individuals, contributions are based on their declared monthly income.

For more detailed information on benefits, coverage, and how to avail of PhilHealth services, you can visit the official PhilHealth website.

Things to Consider Before Choosing an HMO If You’re a Filipino That’s Self-Employed

Now that you’re well aware of HMOs, here are some factors to keep in mind when choosing one:

Coverage and Benefits

Inpatient and Outpatient Coverage:

Determine whether you need comprehensive coverage that includes both inpatient and outpatient services. Some plans, like Maxicare, offer extensive outpatient benefits which can be a good complement to inpatient-focused plans like Pacific Cross Select.

Emergency Services:

Evaluate the emergency care coverage. Plans like ER Vantage Plus 80 for Adults provide significant emergency coverage, which is crucial for unexpected medical situations.

Preventive Care:

Check if the plan includes preventive care services such as annual physical exams, vaccinations, and routine health screenings. Plans like AXA Health Care Access emphasize preventive care.

Specialized Treatments:

If you need specific types of care, such as maternity benefits, mental health counseling, or dental and vision coverage, ensure the plan offers these. For example, AXA Global Health Access includes mental health counseling and maternity care.

Network and Accessibility

Accredited Providers:

Verify the network of accredited hospitals, clinics, and doctors. It’s important that your preferred healthcare providers and nearby hospitals are included in the network. PhilHealth and Medicard have extensive networks, which can be beneficial.

Geographical Accessibility:

Consider the location of the accredited facilities. Choosing an HMO that has a strong presence near your residence or frequently visited locations ensures convenient access to healthcare services.

Specialist Access:

Ensure the plan allows consultations with specialists without requiring referrals, and check if your preferred specialists are within the network. AXA Global Health Access provides the freedom to choose specialists even outside their network, subject to certain conditions.

Financial Considerations

Premiums and Co-Payments:

Compare the monthly premiums and co-payment requirements. Ensure that the plan fits within your budget while providing the necessary coverage. For instance, ER Vantage Plus 80 for Adults is relatively affordable at PHP 1,750 per month but offers substantial emergency coverage.

Benefit Limits:

Understand the annual benefit limits and sub-limits for specific services. Plans like Pacific Cross Blue Royale offer high annual benefit limits, which can be crucial for extensive medical needs.

Reimbursement Policies:

Check the reimbursement policies, especially if you prefer or need to use non-network providers. Some plans, like those from Pacific Cross, offer significant reimbursement options for out-of-network services.

Additional Services and Flexibility

Teleconsultation and Remote Services:

With the increasing importance of telemedicine, consider plans that offer 24/7 teleconsultation services. AXA Health Care Access and AXA Global Health Access provide this convenience.

Family Plans and Discounts:

If you plan to enroll family members, look for plans that offer family coverage and premium discounts. AXA Health Care Access offers a 10% premium reduction for enrolling additional family members.

Longevity and Post-Retirement Benefits:

Evaluate whether the plan offers benefits that continue into retirement. The Longevity Health Fund offered by AXA Health Care Access is an example of such a benefit.

Specific Health Needs

Pre-existing Conditions:

If you have pre-existing conditions, ensure the plan provides adequate coverage for these. Plans like those from AXA and Pacific Cross may be more accommodating, though specific exclusions and limitations may apply.

Mental Health Services:

Consider plans that offer mental health services, especially if you anticipate needing counseling or psychiatric care. Both AXA Global Health Access and AXA Health Care Access provide mental health counseling.

Pandemic Coverage:

In the context of ongoing global health challenges, check if the plan covers pandemic-related treatments and complications from vaccinations, as offered by AXA Health Care Access.

Conclusion

By thoroughly evaluating these factors, you can make an informed decision on the best HMO plan that suits your healthcare needs and financial capabilities as a freelancer in the Philippines.

Juan Remote Work is a site dedicated to assisting Filipino freelancers with any challenges related to online work. Topics like ‘how to convert blog readers into customers‘ and ‘is freelancing still worth it today?’ are examples of what you can explore on our blog.

If you ever need any help with work, job interviews, and so on, please don’t hesitate to reach out. Our aim is to help you secure that juan remote work as quickly and effectively as possible.

Take care!

FAQs

What is the difference between HMO, health insurance, and medical insurance?

HMOs provide a specific network of healthcare providers with set coverage limits. Health insurance offers comprehensive, customizable coverage including outpatient care. Medical insurance focuses on inpatient care, often with higher coverage limits than HMOs.

Are there HMOs that offer plans specifically tailored for freelancers?

Yes, some HMOs offer plans tailored for freelancers. These plans often provide flexible coverage options, affordable premiums, and comprehensive benefits. For example, Medicard and Maxicare offer plans that cater to the specific needs of freelancers, including both inpatient and outpatient care, preventive services, and mental health counseling.

Can I switch HMO plans if my healthcare needs change?

Yes, you can switch HMO plans if your healthcare needs change. However, it’s essential to understand the terms and conditions of your current plan regarding switching or cancellation. Some HMOs may have waiting periods or penalties for switching plans. it’s advisable to review the policy details and consult with the HMO provider before making any changes.`